Whitepaper

Coinfair—Build the New-Gen DEX Dominating Crypto Trading

Abstract

Crypto trading remains dominated by Web2 centralized exchanges (CEX), accounting for 90–95%① of market volume, with monthly fees of $1 billion to $12 billion being drained from the crypto market②, leading to a constant loss of capital in the industry. The highly anticipated DEX, after years of development, has only addressed the issue of whether it exists or not, with their trading volume accounting for only 5% to 10% of the market. They fail to dominate crypto trading. Successful projects on DEX still need to be listed on CEX to meet trading demands. For mainstream cryptocurrencies like BTC and ETH, most of the trades on DEX are arbitrage following the trends set by CEX. The crypto industry urgently needs a DEX that can dominate crypto trading, keep trading profits within the crypto ecosystem, and provide a safe, transparent, and manipulation-free trading environment.

To address the issues mentioned above, Topo Labs has introduced the newly designed BMM (Best Market Maker) (See Appendix B and C) and DRS (Decentralized Rebate System) on Coinfair.

BMM is the best market maker curve, designed according to the minimalist principle. It can help projects achieve better liquidity, and significantly reduce trading slippage, enabling the complete redistribution of trading fees to market users. Moreover, the algorithm boosts liquidity by 60%, which can greatly lower the costs of acquiring liquidity.

DRS enables real-time distribution of referral rewards, It can significantly increase user stickiness.

Together, they enable DEX to achieve certain advantages over CEX in terms of trading depth and user stickiness, thereby driving DEX’s trading volume to dominate a significant share of the market.

This paper will focus on explaining how Coinfair Air, leveraging BMM & DRS, constructs a new — generation decentralized exchange (DEX) capable of leading cryptocurrency trading.

1. Background Elaboration

Traditional DEXs struggle to dominate crypto trading, mainly due to two key issues:

• Insufficient liquidity–making it difficult for DEX to serve as the primary trading platform.

• Low user engagement–with DEX failing to establish a deep connection with both project owners and users.

To enable DEX to dominate crypto trading, two things must be achieved:

The global trading depth of DEX must be more advantageous than that of top-tier CEX.

Market segmentation.

Match new algorithms to segmented markets.

Enhance trading depth further with the decentralized order book.

In terms of user benefits (for project parties, rebate promoters, and trading users), compared to CEX, it is more attractive (the referral commission potential of DEX is tens or even thousands of times higher than that of CEX), thus establishing a deeper connection with users and encouraging a gradual shift of CEX users towards DEX.

2. Market Segmentation

After extensive research, Topo Labs found that the single algorithm used by traditional DEXs struggles to meet the trading demands of different tokens. Based on volatility, trading can be divided into three categories:

The highly volatile new token market

The mid-range volatile mainstream market (top 100 tokens by market capitalization)

The low volatile stable asset trading pairs

Each type of token requires a different underlying algorithm.

Coinfair has tailored specific algorithms for the mainstream market and new token market, significantly improving key performance indicators in these segmented markets. For stable asset markets, Coinfair adopts a solution similar to Uniswap V3.

Next, we will introduce Coinfair’s new token trading DEX — Coinfair Air — and explain its significant advantages over CEX in terms of trading depth and user stickiness.

3. Coinfair Air’s Solution

3.1 From AMM to BMM: Enhancing Market Depth

3.1.1 Traditional DEX’s Dilemma in the New Token Market

Traditional DEXs typically adopt AMM (Automated Market Maker) algorithms, such as XY=K. However, this algorithm often results in insufficient liquidity for newly launched projects, causing a sharp decline in liquidity during the growth phase of new tokens. This traps projects in a prisoner’s dilemma, reducing their chances of success. After a large volume of trades, the funds remaining in the liquidity pool are usually quite low. While adding liquidity can improve trading depth, the impermanent loss (where liquidity providers’ funds are often worth less than simply holding the assets) is too high (See Appendix A), many users will ultimately suffer severe losses.

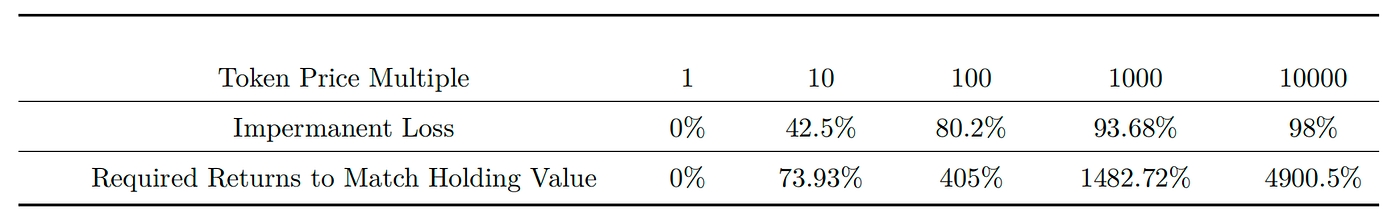

For example, When the token price increases by 100 times, the impermanent loss can reach as high as 80.2%, requiring a 405% return to break even; if the price increases by 10,000 times, the impermanent loss could be as high as 98%, requiring a 4,900.5% return to recover the loss. Such high impermanent loss makes it extremely difficult for liquidity providers to achieve positive returns in the new token market. In the past, users who added liquidity often faced two problems: on one hand, the liquidity issue was not solved, and on the other hand, the liquidity providers faced larger losses than simply holding the tokens. In the rare cases of successful projects, liquidity providers still lost significant returns. This approach is highly unfair to liquidity providers.

On the other hand, injecting funds to boost token prices would only inflate the bubble factor, and selling even smaller amounts of tokens would cause the project to collapse. Simply put, as long as the liquidity issue persists, no amount of funding can sustain a project’s healthy growth, trapping it in a prisoner’s dilemma. This inherent flaw limits the sustainable development of new projects on DEX using this algorithm model. Even the few that successfully break through face insufficient liquidity pools to meet trading demands, forcing them to turn to CEX to fulfill trading requirements. This has led to an awkward situation where projects on popular DEXs like Uniswap, after growing and developing, become heavily reliant on CEXs for trading.

3.1.2 Coinfair Air’s Solution

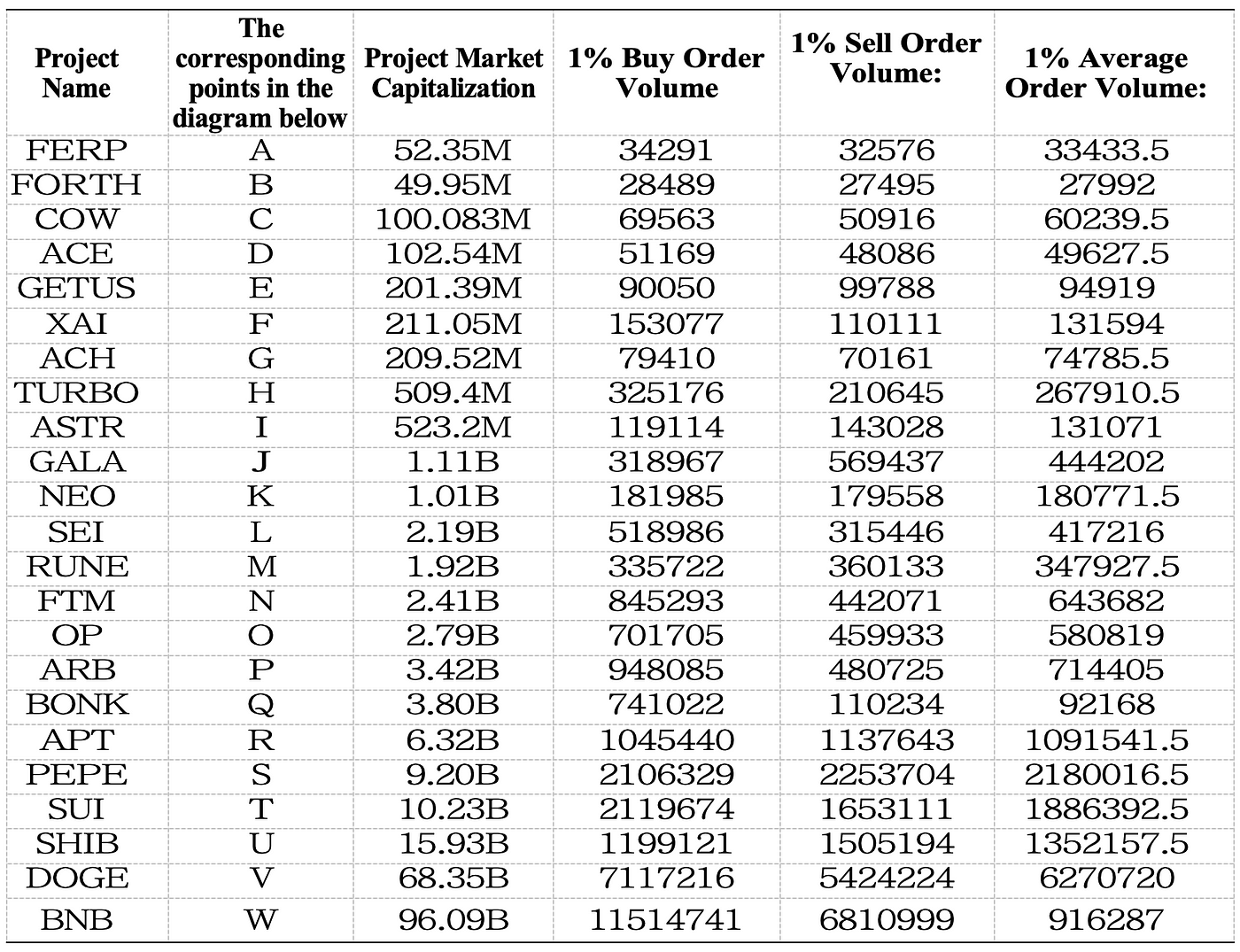

Simplifying the Liquidity Acquisition Process

Considering the limitations of existing AMM in trading depth, Coinfair Air pioneered a novel algorithm for new token markets, addressing liquidity gaps left by traditional AMM systems. Drawing on trading depth data from Binance for projects with market caps ranging from tens of millions to trillions of dollars, we have launched a market-making curve designed with simplicity in mind. To differentiate it, we named it BMM (Best Market Makers). BMM adopts a more streamlined and optimized AMM curve, simplifying the process of acquiring liquidity during the project’s development phase. Just need the project owner to add liquidity initially, the liquidity throughout its development can be on par with that of top CEX (without requiring other users to add liquidity). Users participating in the project no longer face the risk of impermanent loss from adding liquidity, making it easier for the project team or community to grow and develop. The BMM algorithm can further increase liquidity by 60% (See Appendix C), greatly reducing the cost of acquiring liquidity.

Overall, BMM improves trading depth by 1.6 to 100 times③ compared to traditional DEX. As tokens mature and trading volumes increase, their trading depth is comparable to the top-tier CEX. Combined with a decentralized order-book system, Coinfair ’s advantages in trading depth will become even more pronounced. For users, BMM significantly reduces trading slippage, helps them avoid impermanent loss, and allows them to achieve better returns during trading.

Most Web3 projects choose to list on DEX, and once they reach a certain level, they move to CEX to meet increasing trading demands (usually after the price has multiplied dozens or thousands of times). As the chart shows, Coinfair Air offers much better trading depth than Uniswap and other traditional DEXs during these two stages. When transitioning to CEX, Coinfair is capable of achieving trading depth comparable to centralized exchanges like Binance.

The growth phase of a new token on the DEX

Coinfair ’s algorithm guarantees liquidity (trading depth) to improve by 160%-5,000% compared to Uniswap, without the need for project owners to organize users to add liquidity. It also significantly reduces slippage, increasing the project’s success rate. This process will be explained in detail later.

As shown in Table 4, in cases where the initial token price and USDT are equal, and the market cap is equal, Coinfair ’s bubble factor (market cap/LP) remains within a healthy range as the market cap grows. After substantial fund transactions, the amount of USDT retained by Coinfair is higher than Uniswap. During market cap growth, Coinfair retains USDT amounts that are 1 to 63 times higher than Uniswap. At the same time, Coinfair’s algorithm comes with a 60% liquidity boost, effectively increasing overall liquidity and significantly reducing the cost of obtaining liquidity.

See Appendix C for detailed elaboration.

Development Stage on CEX

Coinfair’s BMM provides liquidity approximately 20–100 times that of Uniswap and around 60%-150% of the liquidity on projects with similar market caps on Binance. When combined with order book liquidity, Coinfair can outperform top-tier CEX in terms of trading depth.

Balanced Design — Moderate Liquidity

A poor liquidity algorithm stifles project development, while excessive liquidity results in low capital efficiency. Coinfair balances these factors and designs an algorithm suited for new token trading based on the liquidity of top-tier CEX. This ensures the project develops smoothly and healthily while maintaining capital efficiency.

During a downturn, the USDT in Coinfair ’s pool is significantly lower than in Uniswap, but the trading depth remains better (as more USDT is received for the same amount of tokens exchanged, resulting in lower slippage). When tokens drop by approximately 93.36%, Coinfair ’s trading depth falls below Uniswap ’s, but by then, the token drop is so severe that it becomes meaningless. As long as tokens remain within a normal price range, Coinfair maintains an advantage. Overall, Coinfair fully leverages its advantages while avoiding weaknesses.

In summary, Coinfair holds a significant advantage in liquidity and trading depth during a project’s normal growth stage. If a project experiences an extreme drop (with the token price falling more than 93.36% from its opening price), Coinfair has a disadvantage. However, at that point, the project has lost its significance. If the project recovers to a normal range, the aforementioned advantages remain intact.

3.2 Decentralized Rebate System: How Coinfair Air Has More Advantages in Terms of Operation and User Stickiness

The AMM algorithm used by traditional DEXs results in insufficient trading depth, and because liquidity providers cannot effectively earn sustained profits, user stickiness is poor. Currently, the daily trading volume of decentralized exchanges (DEXs) ranges between $10 billion and $30 billion④. All DEXs collectively generate total daily transaction fees of approximately $30 million to $90 million⑤. If these fees could be effectively utilized in the market, DEXs would have an extremely strong competitive edge. Due to poor liquidity, traditional decentralized exchanges (DEXs) need to return the vast majority of transaction fees back into the liquidity pools to attract external liquidity. This leaves no funds allocated for marketing, resulting in poor user retention. Ultimately, they fail to effectively solve the liquidity problem; in most cases, liquidity providers suffer significant losses due to high impermanent loss, creating a lose-lose situation. Coinfair ’s BMM enables projects to achieve trading depth comparable to that of leading centralized exchanges (CEXs) during their development phase. The corresponding transaction fees can be entirely allocated to marketing, and these funds can even exceed those that CEXs allocate for marketing, significantly e nhancing u ser s tickiness. Coinfair i ntroduces a D ecentralized Rebate System (DRS), which enables DEX to operate like CEX by providing decentralized trading rebates. Incentive measures can be set on a monthly, quarterly, and annual basis. Notably, in the case of new tokens, the expected rebate income can be dozens to thousands of times greater than that of leading CEX. Combined with more reasonable fee allocation and innovative trade- to- mine mechanisms, Coinfair Air has a certain operational advantage over CEXs. On one hand, it helps hardworking project teams earn sustained revenue; on the other hand, it greatly stimulates user participation and market activity. This attracts more KOLs (key opinion leaders) to participate in rebate promotion, generating core buy-side tra ic that CEX cannot provide, and continuously driving increased user migration to DEX.

3.2.1 Decentralized Rebates Far Surpassing CEX

Coinfair has pioneered decentralized rebates in DEXs, with corresponding rebate revenues expected to be tens to thousands of times higher than those on CEXs, aligning rewards with token growth cycles. Here’s the comparison:

Rebate Situation on CEXs

When a project is listed on a CEX, the price increase is typically modest. If user A influences $1 million, the rebate received when these funds are used to purchase tokens on the CEX is only 100 dollars⑥. Given that the price increase is generally not high, often failing to reach tenfold, user A cannot achieve the tens of times to tens of thousands of times rebate increase that could be seen on platforms like Coinfair. As a result, the rebate income from selling is also low.

Rebate Situation on Coinfair

With the combination of DRS (Decentralized Rebate System), rebate users on Coinfair can receive rebates for the entire token development cycle. In terms of commission rebate rates, Coinfair offers three trading fee tiers: 0.3%, 0.5%, and 1%. The initial rebate rate is set at 30%, with a standard rebate rate of 40% upon meeting the criteria. This translates to an overall rebate rate ranging from 0.09% to 0.4% of the trading volume. Compared to CEX, which typically offers a rebate rate of approximately 0.01%, Coinfair ’s rebate rate is 9 to 40 times higher, and rebates are credited in real time. In terms of price appreciation: Since the token price increases on DEX typically range from tens to even millions of times, the corresponding rebate income also experiences an increase of tens to millions of times. In contrast, price increases on CEX are relatively small, meaning rebate income expectations on Coinfair are dozens to thousands of times higher than those on CEX. This will attract more KOLs and rebate users to actively participate in promotions, gradually shifting CEX users to DEX. Through DRS, Coinfair can also build an AI-driven decentralized reputation system, further enhancing user stickiness on the platform.

3.2.2 Fee Collection and Distribution

Due to insufficient liquidity, traditional DEXs return most of their fees to the liquidity pool. In contrast, Coinfair Air, with its abundant liquidity (as previously demonstrated to surpass top CEXs), does not require additional external liquidity, and all fees are returned to the market.

Fee Collection

In terms of fee collection, traditional DEXs charge in both the priced tokens and project-issued tokens.

Charging project-issued tokens can significantly impact token prices when sold, potentially leading to project collapse. Coinfair, however, only charges in priced tokens, such as USDT, USDC, ETH, BNB, SOL, etc., from each trading pair. This method prevents negative price impacts on project-launched tokens, ensuring stability and sustainability for projects.

Fee Distribution

Coinfair Air allocates transaction fees as follows: 30% to liquidity providers (typically the project owners), 30%-40% for rebates, and 30–40% as protocol income for token empowerment. Coinfair can settle each commission in real time, and users incur very low GAS costs.

3.2.3 Trade to mine

Additionally, Coinfair Air periodically settles trade-to-mine rewards based on users ’trading volumes. This incentivizes users to trade, providing benefits to both projects and users while highlighting the decentralized, equitable, and inclusive principles of DEXs.

3.2.4 Comparison of Project Development on Coinfair vs. CEX

When a project is listed on a CEX, the project owners need to spend a large amount of tokens and USDT for the listing, along with the necessary market-making assistance, further driving up costs. Despite the project’s success, project owners cannot earn significant fee revenue, and the most crucial buying market remains controlled by the CEX. If a project develops on Coinfair, the project owner can earn thousands to hundreds of thousands of dollars in transaction fees daily. Outstanding projects can even earn millions to tens of millions of dollars in daily fee revenue. Correspondingly, KOLs or Builders can also earn high rebates, driving a stronger market push, while buying users will join the community to strengthen the project. Additionally, each purchasing user can earn the corresponding trade-to-mine, enabling all parties to benefit.

3.2.5 Scale of Coinfair Air’s Market Incentive Funds

Thanks to its liquidity advantage and innovative operational model, Coinfair Air can return considerable profits to the crypto trading market while driving project growth and facilitating the migration of trading from DEX. Specifically, the current daily trading volume on DEXs is 10–30 billion. Using Coinfair ’s model, it can return 30–90 million in daily profits to the market (calculated at a 0.3% fee rate). Given Coinfair ’s ability to dominate crypto trading, once mature, it could return hundreds of millions of dollars in daily profits to the market.

4. Conclusion & Outlook

Coinfair Air addresses the liquidity issues in the new token market of existing DEXs through innovations in underlying algorithms, significantly improving performance indicators compared to Uniswap and other traditional DEXs. It simplifies the process of acquiring liquidity, enabling projects to succeed all the way on DEX. Thanks to its liquidity advantage, Coinfair Air implements decentralized rebates and more user-friendly revenue distribution, strengthening the bond between projects and users and realizing the decentralized ideals of equality, transparency, and inclusivity in operations. Finally, Coinfair Air’s innovative technology and operational model continuously return profits to the crypto market, counteracting the chronic capital drain caused by CEX dominance, locking crypto funds and trading within the crypto ecosystem, promoting market prosperity, and growing the market pie to benefit every crypto citizen. In another critical crypto trading market — the mainstream market — can Coinfair continue to challenge CEX dominance? This will be the subject of the next article, so stay tuned.

Appendix

A: Formulas Related to Impermanent Loss

Below, we take Uniswap, the first to introduce the algorithm into DEXs, as an example.

Uniswap’s formula for impermanent loss is:

Through derivation, we can obtain:

Given that a and b are positive integers, and assuming a > b due to symmetry, the formula for impermanent loss is:

B: Demonstration:

The following derivation provides the expression for trading depth (in terms of the change in USDT) when the price fluctuates by a% (corresponding to a price decrease of a%).

For projects with a small initial volume, where all tokens are added to the liquidity pool:

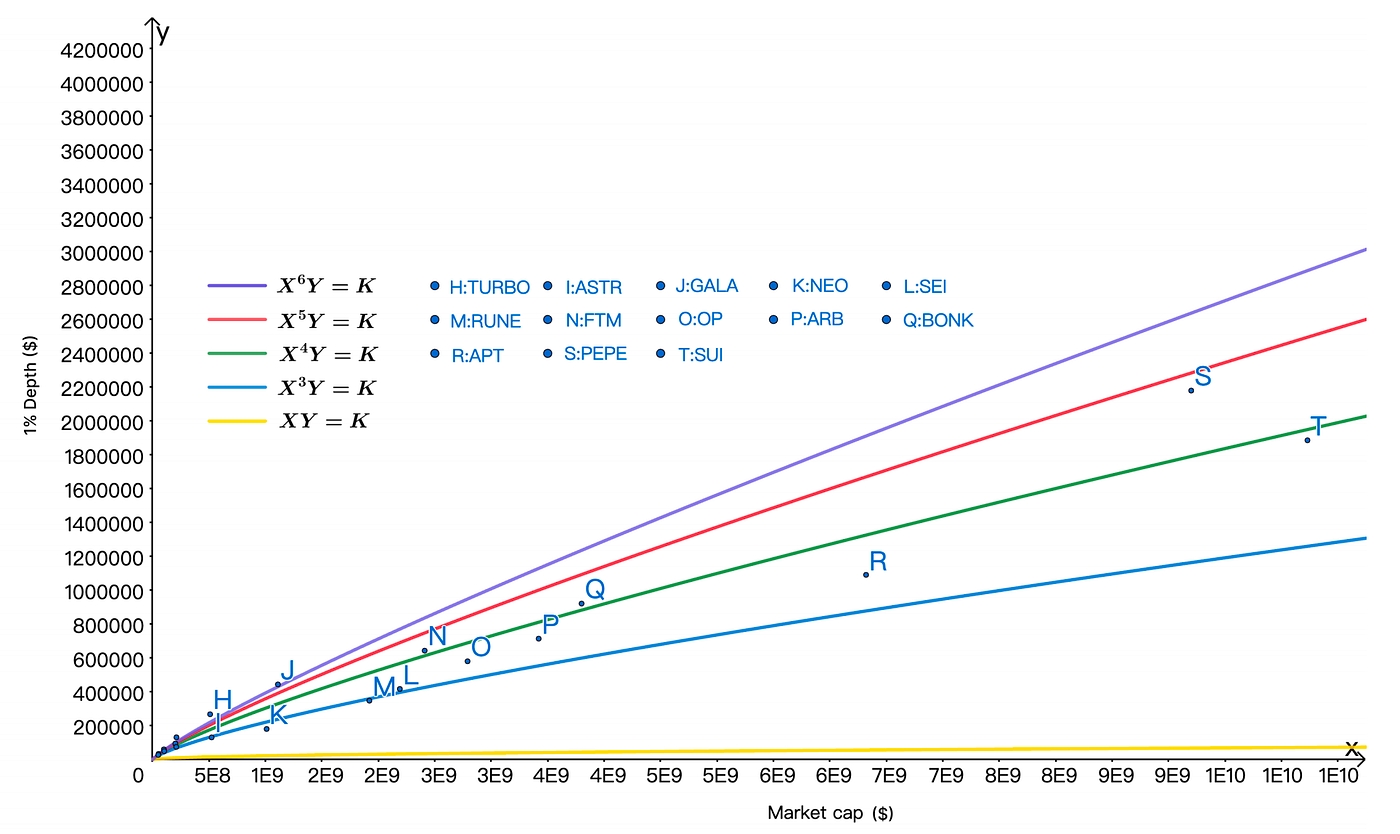

Plotting the Trading Depth Chart for Different Algorithms(XY = K , X³Y = K , X⁴Y = K , X⁵Y = K , X⁶Y = K)with Y0 = 10,000, a% = 1%:

Plotting the Trading Depth Chart for Different Algorithms(XY = K , X³Y = K , X⁴Y = K , X⁵Y = K , X⁶Y = K)with Y0 = 5,000, a% = 1%:

Plotting the Trading Depth Chart for Different Algorithms(XY = K , X³Y = K , X⁴Y = K , X⁵Y = K , X⁶Y = K)with Y0 = 20, 000, a% = 1%:

From Figures 6 to 7, first, when liquidity is added with different capital volumes at various market cap stages. the AMM algorithm curve adopted by Uniswap is clearly unable to match the trading depth of Binance representative projects across the entire market capitalization range. Secondly, the curve for the X³ Y = K algorithm also demonstrates a significant disadvantage compared to Binance in the above comparisons. In contrast, X⁵Y = K and X⁶ Y = K algorithms not only match but even surpass the trading depth of Binance projects across the entire market capitalization range, which is particularly evident in the high market capitalization stage.

However, as discussed in Section 3.1.2, trading depth serves as a positive driver for project development to

some extent, but it is by no means the higher, the better. Excessive funds may be required for further project development, leading to low capital utilization and hindering project progress. (especially new token projects), thereby hindering their progress. Even if sufficient funds are available, it can lead to a significant reduction in circulating external funds, severely impacting capital efficiency.

By observing Figures 6 to 10, projects with added liquidity at different capital volumes show different algorithm curves as their market caps grow. Comparing these with the corresponding trading depth data of projects on Binance at different market cap stages, it is evident that the X⁴Y = K curve aligns well with the average trading depth of Binance projects. Specifically, the majority of new crypto projects currently have an initial market cap in the range of a few thousand to tens of thousands of USD. Based on the trend in the charts, as these projects grow to a certain market cap and get listed on CEXs, the X⁴Y = K trading depth curve consistently provides solid trading depth, And when the project grows to the stage of being listed on a CEX, its trading depth will be roughly comparable to that of Binance projects. Considering both trading depth and capital efficiency, this makes the optimal market maker curve for new token markets under the principle of minimalism. This is also the origin of the term BMM (Best Market Maker).

For projects with a big initial volume, where partial tokens are added to the liquidity pool

Assume that the liquidity-added token accounts for m% of the total supply. thus:

C The Argument for Liquidity Enhancement via BMM in Coinfair

C.1 The Demonstration for Higher Capital Retention

Last updated